Self Assessment filing is here for limited company directors

Roan Lavery

CEO, Co-founder

Big news for limited company directors: from today you can file your Self Assessment return through FreeAgent.

Earlier this year you may have heard that we released filing of Self Assessment returns for sole traders but from today, directors of limited companies can fill in and file their tax returns directly to HMRC too.

So let’s see how it’s done.

Fill in the forms…

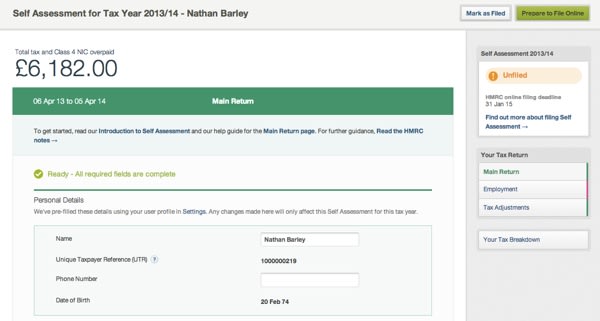

When you visit the Self Assessment section of your account you’ll see a lot has changed, with expanded support for the common Self Assessment return forms including the Main Return, Employment Form and Tax Adjustments.

Where possible, FreeAgent will populate these forms with the correct data from your account, so you don’t have to enter this again. For example, if you run payroll through FreeAgent we’ll automatically create an Employment form and populate this with your payroll data. We’ll also populate the Main Return Form with details of any dividends you’ve recorded.

All you need to do is go through and complete the rest of the forms, answering the clearly marked questions and filling in any data FreeAgent doesn’t know about.

… and file to HMRC

Once you’ve filled in the forms, filing is easy. Select the 'Prepare to File Online' button and you’ll see a final page that highlights any missing data and encourages you to double-check the data you’ve already entered.

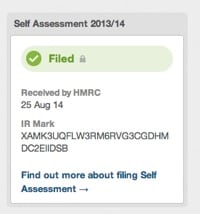

Then if you're ready to go, simply hit the 'File Online with HMRC' button and enter your Government Gateway ID and password. You’ll be taken back to the self assessment section and you’ll see the return marked as 'Pending'. If all goes well, this will change to 'Filed' when the return has been successfully received by HMRC.

And it’s as simple as that, but if you want the full skinny then take a look at our guide to filing a Self Assessment return with FreeAgent.

Locking

When Self Assessment returns are filed to HMRC, or simply marked as Filed, then anything that affects the Self Assessment return (like payslips, dividends or dividend journals) will be locked down. See our Knowledge Base article for details.

If you file a return and then realise you’ve made a mistake you can unlock the return, allowing you to make the amendment. Just remember to submit the return again once you’ve finished, and bear in mind that HMRC do place a limit on how many times you can refile.

Obviously we recommend checking your return thoroughly before submitting to avoid any mistakes, and if you have an accountant make sure they look it over.

Who can file their Self Assessment return through FreeAgent?

At the minute FreeAgent supports most of the common Self Assessment forms, but we don’t cover everything. If you have income from a property for example, you won’t be able to file through FreeAgent yet. For full details of what we currently support, see our overview of Self Assessment in FreeAgent.

We think you’ll agree this is another major step forward in our mission to take away the pain of managing small business accounts, and look forward to seeing what you think.

Happy filing,

Roan and the team at FreeAgent