MTD for Income Tax workload calculator

Preparing clients for MTD for Income Tax is no easy task. Plan ahead by estimating how long it could take to move your affected clients to digital software.

To get a more personalised calculation, book a free MTD action plan with one of our experts. You’ll get a tailored action plan with a clear idea of your next steps.

Total hours required

This is how long it will take to migrate your affected clients.*

0 hours

Number of working days until MTD for Income Tax

Based on a five-day week, this is how many working days you have between today and 6th April 2026, not taking into account any holidays.

445 days

Hours per week required

Based on the information above, this is how much time you’ll need to spend every working week between now and 6th April 2026 in order to prepare your clients for MTD for Income Tax.

0.00 hours/week

If you’re a FreeAgent Partner, head to the Practice Portal to discover a host of exclusive resources, including our MTD for Income Tax pack which includes flyers, guides and handy email templates.

You can also learn more about FreeAgent for Landlords, a version of our award-winning software designed specifically for clients who earn income from property, and sign up for partner-exclusive webinars.

For more help and advice on getting your practice and clients ready for MTD for Income Tax, speak to your account manager.

Not yet a FreeAgent Partner? Find out about all the benefits of using FreeAgent in your practice and try it for free.

Who will be affected by MTD for Income Tax?

HMRC has advised that MTD for Income Tax will come into effect from 6th April 2026. Self-employed individuals and landlords with a total business and/or property income above £50,000 per year will have to comply with MTD for Income Tax from that date.

What are the requirements for those affected?

All affected self-employed individuals and landlords will need to:

- sign up for MTD for Income Tax via HMRC's website

- keep digital business records

- use MTD-compatible accounting software such as FreeAgent

- send quarterly business income and expenses updates to HMRC through the software

- finalise the business’s income in a declaration which confirms that the updates sent are correct, and make any accounting adjustments

- submit this final declaration to HMRC

* This calculation assumes that it will take a minimum of four hours to convert one client, based on feedback from our Practice Partners.

Disclaimer: We have made every attempt to make sure that the calculations are correct but FreeAgent Central Ltd cannot be held responsible for incorrect output from this calculator or for the outcome of any decisions you make as a result of using it. Full terms and conditions.

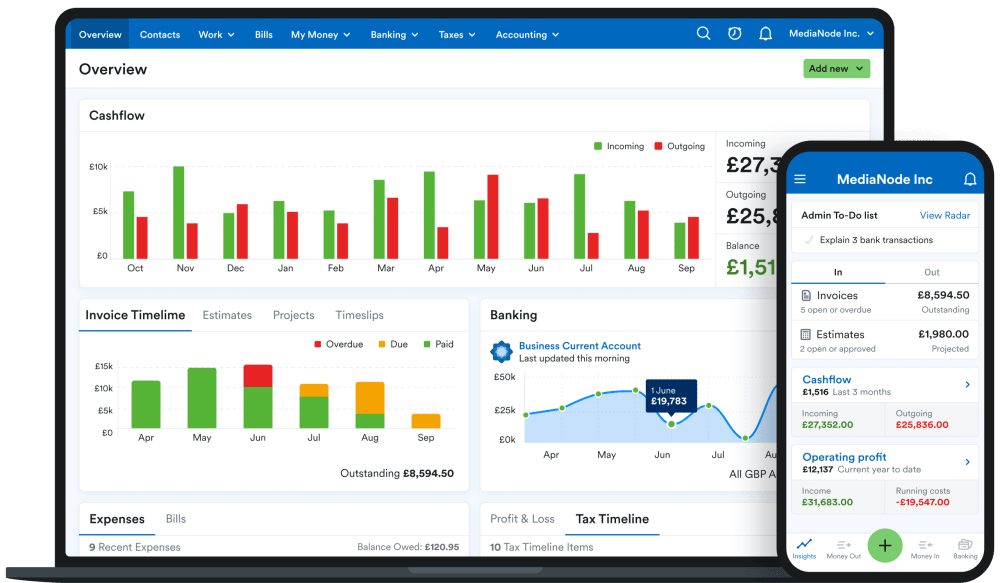

Say hello to FreeAgent!

Award-winning accounting software trusted by over 200,000 small businesses and freelancers.

FreeAgent makes it easy to manage your daily bookkeeping, get a complete view of your business finances and relax about tax.