Everything you need to know about Self Assessment payments on account

This article was written by FreeAgent’s Content team and our Chief Accountant, Emily Coltman FCA.

If you’re a UK taxpayer who pays less than 80% of your income tax at source and your tax bill is over £1,000, you may well be told by HMRC to make ‘payments on account’. This guide explains what payments on account are, when you need to pay them, and what to expect when making payments on account for the first time.

What are payments on account?

Payments on account are payments towards your next year’s Income Tax. The amount you have to pay for each payment on account is half of your previous year’s tax bill. So if your tax bill for this tax year is £1,500, then you would also have to make two payments on account totalling £1,500 towards next year’s bill.

When are payments on account due?

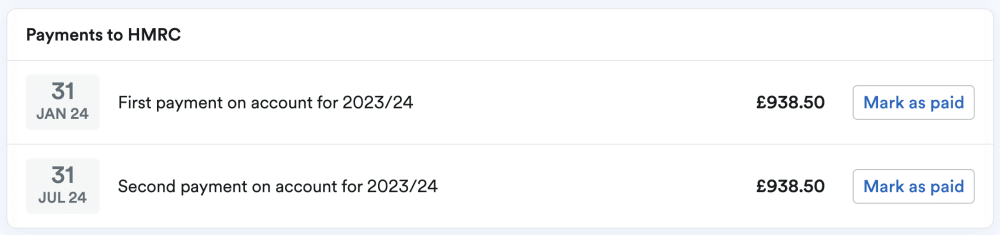

Payments on account are due on 31st January during the tax year, and 31st July soon after its end. For example, on 31st January 2026 and 31st July 2026 you may be told to make payments on account towards the tax that you’re going to have to pay on your income for the 2025/26 tax year, even though the tax return for that year is not due until 31st January 2027.

If you end up paying too much, HMRC will give you the difference back, either via cheque or bank transfer or by deducting the difference from your next tax bill.

Applying to reduce your payments on account

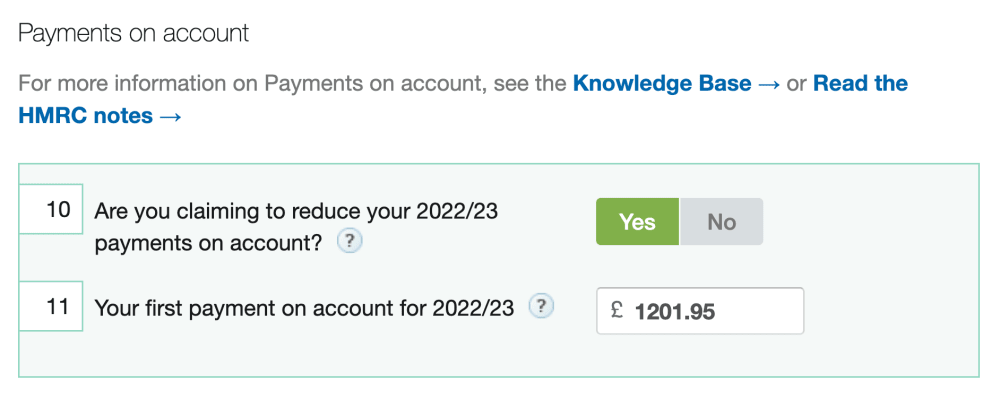

You may know in advance that you will pay too much on account because your tax bill next year will be lower. This could be because you’re winding your business down, for example, or because you’re passing retirement age and will no longer have to pay Class 4 National Insurance. If this is the case, you can apply to HMRC to reduce your payments on account.

If you’re a FreeAgent user, you can also apply to reduce payments on account as you fill in your return by selecting ‘Yes’ in box 10 of the Tax Adjustments form.

Be aware that if you reduce your payments on account too far HMRC will charge you interest and penalties for underpaying your tax. Always consult with an accountant if you’re in any doubt about what you should be paying.

Balancing payments

When you complete your tax return it might transpire that this year’s tax bill is actually higher than last year’s. As a result, you might owe more tax than you’ve already paid via payments on account. If this is the case, you’ll need to make a ‘balancing payment’ to HMRC by 31st January of the following tax year.

For example, if you’ve made a payment on account of £1,500 towards your 2025/26 tax bill and you find that you’re actually due to pay £1,700 when you complete your tax return, you’ll be required to make a balancing payment of £200 to HMRC by 31st January 2027.

Your balancing payment is also where you’ll pay anything you owe for Capital Gains Tax and student loans as these are not included in the calculation for payments on account.

Your Self Assessment tax bill is essentially a combination of balancing payments for the previous tax year and payments on account towards the next year’s tax bill.

Making payments on account for the first time

It’s important to know what to expect when you make payments on account for the first time, either in your first year of trading or the first time your tax bill is over £1,000 in a tax year.

If you began trading in 2024/25 and have a tax bill of £1,400 for that year, then that tax bill would be due for payment on 31st January 2026. However, because your tax bill is over £1,000, you’d also have to make your first payment on account (£700, half the prior year’s tax bill) for 2025/26 by 31st January 2026 - in addition to your tax bill. This means that you’d owe £2,100 to HMRC on 31st January 2026.

This can come as an unpleasant surprise and is one reason why it’s a good idea to do your tax return as early as possible - so you have time to put money aside!

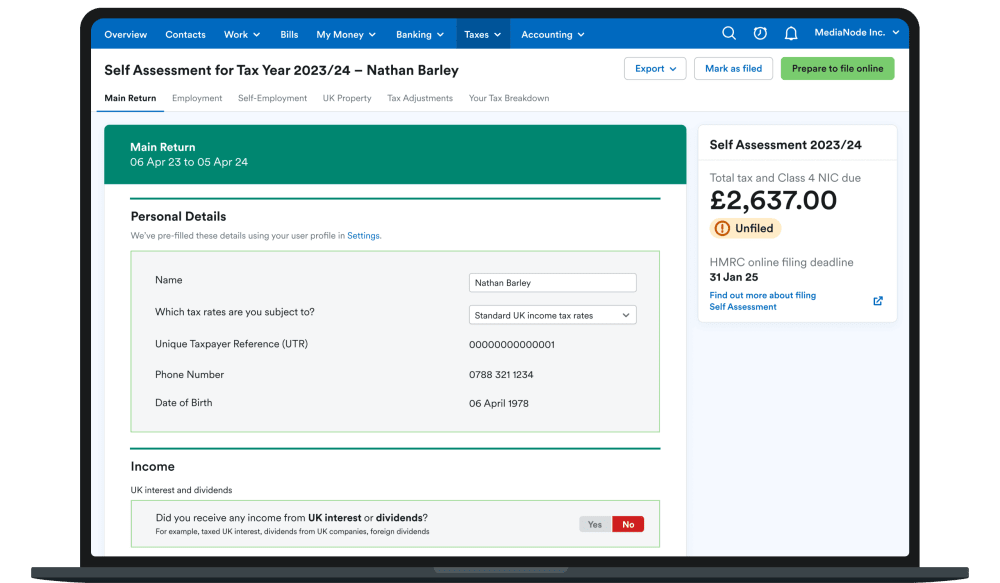

Predict payments on account with FreeAgent

As you fill in your Self Assessment tax return using FreeAgent you’ll see how much you can expect to pay on account. The same amount will be due again by 31st July and you’ll be reminded of this, as well as any other upcoming tax deadlines and amounts, on the Tax Timeline on your account dashboard.

Your Tax Timeline will also help make sure you have enough money in your bank account to cover all your upcoming tax bills. Find out more about how FreeAgent can help you prepare for Self Assessment.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.