What is cashflow?

Cashflow is money coming into and going out of your business. It can refer to physical cash in your hand or cash in your business’s bank account. Cashflow is usually measured over a period of time, for example a month or a three-month period. Maintaining healthy cashflow is key to keeping your business afloat.

Before we dive into any more detail, let’s cover the basics and explain some more key terms. If you’re already something of a cashflow expert, feel free to jump ahead to another section using the links below.

Why cashflow is important

How cashflow keeps your business afloat

Calculating your net cashflow

How to calculate it and the insights it provides

How to create a cashflow forecast

Plan ahead effectively and have money in case of an emergency

How to improve your cashflow

Keep a close eye on money coming in and going out

What are ‘positive’ and ‘negative’ cashflow?

‘Positive cashflow’, ‘healthy cashflow’, or ‘net cash inflow’, means that your business has received more cash than it has spent. This is usually a good sign (particularly if your business hasn’t borrowed any money) as it often means you are receiving more from your day-to-day trading than you’re spending.

‘Negative cashflow’, or ‘net cash outflow’, means that your business has spent more cash than it has received. This isn’t usually a good sign, as it means your business isn’t bringing in enough from its day-to-day activities to cover what it’s spending.

We’ll talk more about how to calculate your cashflow later.

What’s the difference between cashflow and profit?

Cashflow is the money that comes in and goes out of your business throughout a given period. Profit is whatever remains from your invoiced revenue after you’ve deducted costs.

Not all the same items go to make up these two figures. For instance you may have bought an asset which will reduce your cash balance but not affect your profit. Or you might have made a sale you haven’t been paid for yet, which will boost your profit but not affect your cash.

We’ll talk more about why cashflow is important later.

What is net cashflow?

Net cashflow is the difference between the cash inflow (money coming in) and cash outflow (money going out) of your business. It tells you the amount of money your business has brought in or paid out during a given period (e.g. a month or a calendar year).

A positive net cashflow (more money coming in than going out) is sometimes referred to as ‘net cash inflow’.

A negative net cashflow (more money going out than coming in) is sometimes referred to as ‘net cash outflow’.

Understanding your business’s net cashflow can give you a clearer picture of your finances by showing whether you’ve spent more than you’ve received, or vice versa, over a given period of time.

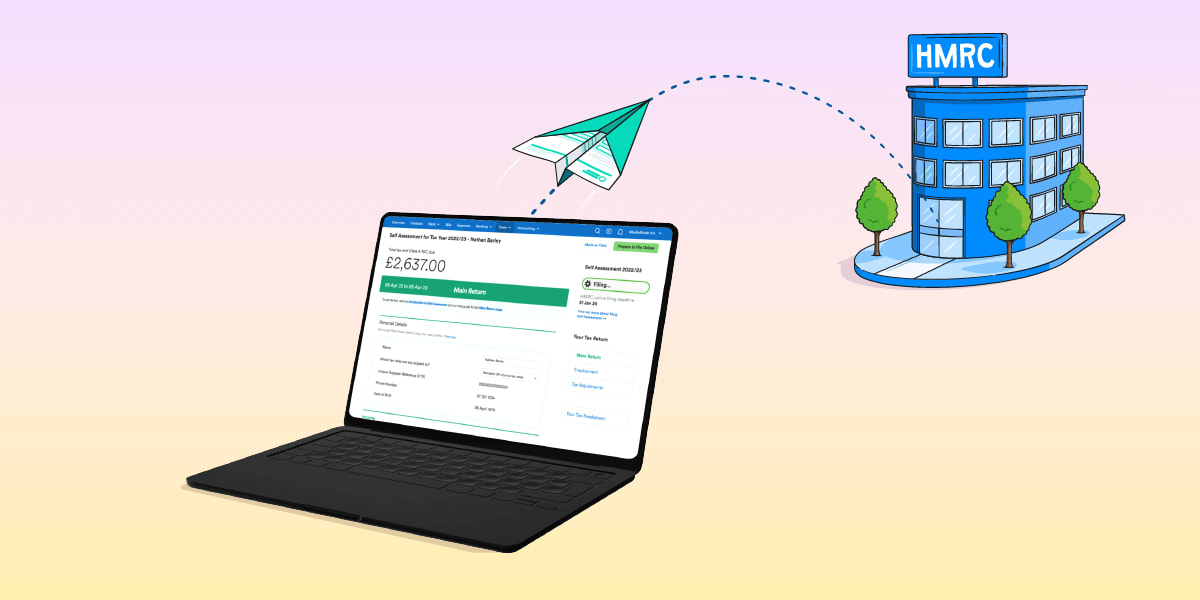

What is a cashflow statement?

A cashflow statement is a financial statement that records the cash generated and spent over a certain period.

While a cashflow forecast (see below) predicts future cashflow, a cashflow statement records the actual money coming in and going out of a business over a specified period.

What is a cashflow forecast?

A cashflow forecast is a document that estimates the amount of money that will come in and go out of your business in the future. It may also include your projected income and expenses.

Cashflow forecasts often cover the next 12 months but can also be used for shorter periods, such as a week or a month.