RTI is upon us

Roan Lavery

CEO, Co-founder

Lo, HMRC cometh with the introduction of RTI, but FreeAgent stands tall at your side, helping you navigate the treacherous waters.

We’ve been talking about this for months now, and the date is finally upon us all. From April 6th , HMRC now requires Payroll information to be filed when you pay your staff, in real time.

Our last release introduced a new workflow for 2013/14 Payroll, so hopefully you’ve all had a chance to try this out. This release contains the final piece of the puzzle and enables you to file PAYE information through to HMRC as a RTI submission.

How does it work?

The new workflow for submitting payroll data to HMRC works like this:

- Creating Payroll Profiles for staff on your payroll

- Run Payroll once a month to create payslips

- Submit PAYE information in real time (RTI) to HMRC

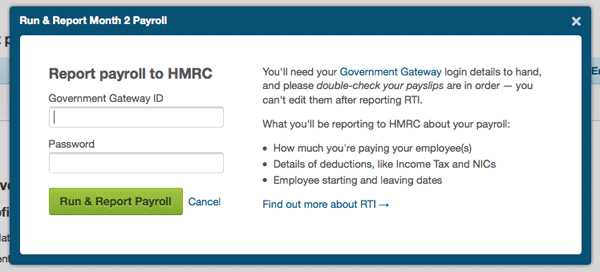

When you Run & Report Month 1 Payroll you’ll be asked to enter your Government Gateway credentials. Do this and we’ll file the payroll information with HMRC - and that’s all you need to do.

You’ll be taken back to the Month 1 Payroll screen where you should see the payroll submission as Pending, and then Filed! And that’s you for another month!

Until next time,

Roan and the team at FreeAgent

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.