5 things business owners and landlords will have to do when MTD for Income Tax rolls out

Important: This blog post was published before the government announced that MTD for ITSA will be delayed until 2026. Some of the information below is no longer accurate.

Big changes are coming to the way self-employed business owners and landlords report their earnings to HMRC. Here’s a simple guide that outlines everything you’ll have to do to prepare for and follow the new rules.

What’s changing and who does it affect?

HMRC’s new Making Tax Digital (MTD) for Income Tax rules will come into effect in April 2024. Self-employed business owners and landlords with a total business and/or property income above £10,000 per year will have to comply with MTD for Income Tax from their first accounting period starting after that date.

Instead of submitting a Self Assessment tax return once a year, affected businesses and landlords will need to use MTD-compatible accounting software to send quarterly updates about their earnings, followed by a final update at the end of the year.

What will you need to do?

If the changes affect you, here are five things you’ll need to do to comply with the new rules:

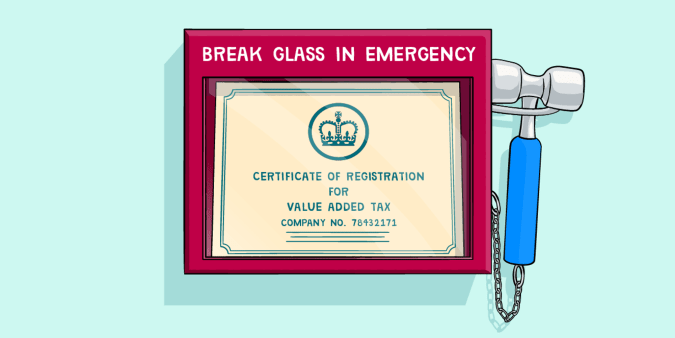

1. Sign up for the initiative via the HMRC website

If your annual taxable turnover from your self-employed business or your annual income from property is above £10,000, you will have to follow the rules from 6th April 2024, so you will need to sign up at some point before that date.

An MTD for Income Tax pilot scheme has been running since 2018 and a number of eligible businesses and landlords can choose to sign up and follow the rules voluntarily now. Check out this guidance on signing up for MTD for Income Tax to find out more about how to get started. HMRC has announced that the pilot scheme will be gradually expanded during the 2022 to 2023 tax year, ready for larger-scale testing in the 2023 to 2024 tax year.

If your accountant, bookkeeper or tax agent is signing up on your behalf, HMRC has outlined a separate process for them to follow.

2. Keep digital business records

Under the MTD for Income Tax rules, you’ll need to keep digital records of all your business income and expenses - this includes all income from self-employment or property. You should start to keep digital records at the start of the accounting period you are signing up for, and you’ll need to do this for the whole of the accounting period.

To keep digital records, you’ll need to use software that’s compatible with MTD for Income Tax, as you’ll also need to send these records to HMRC via a digital link.

3. Get MTD-compatible accounting software

FreeAgent supports MTD for VAT submissions and it’s on HMRC’s list of compatible software for MTD for Income Tax for businesses. This means that if you’re a business owner, you’ll be able to use FreeAgent to follow the rules of MTD for Income Tax and make the required tax submissions to HMRC before the legislation comes into effect in April 2024. We’re working closely with HMRC to ensure that FreeAgent will support MTD for Income Tax submissions for property through FreeAgent for Landlords - a brand new version of our software that’s built specifically for landlords - before the legislation comes into effect in April 2024. Find out more about how FreeAgent supports Making Tax Digital.

FreeAgent’s powerful automation features can help you get your accounts in order with minimal hassle. Our Open Banking bank feeds automatically import your bank transactions into your FreeAgent account, which will save you time when you prepare your accounts ahead of sending updates to HMRC.

4. Send business income and expenses updates

Once you’re signed up to MTD for Income Tax, you’ll need to send a summary of your business income and expenses to HMRC every three months. Your accounting software will tell you how and when to send the updates.

Sending updates will enable you to see a year-to-date calculation of how much tax you owe at any time, helping you to budget accordingly.

5. Finalise your business income

At the end of your accounting period, you’ll need to finalise your business income in a final declaration. This is where you confirm that the updates you sent are correct, add any details about personal income or reliefs and make any other accounting adjustments. This final declaration replaces the current Self Assessment tax return.

Once your final declaration is submitted you’ll be able to see a tax calculation either in your software or in your HMRC account. Just as with Self Assessment, you’ll have to pay the tax you owe by 31st January the following tax year.

Ready to start keeping digital records ahead of the rollout of MTD for Income Tax? Try a 30-day free trial of FreeAgent’s award-winning accounting software.

Last updated 8 September 2022.