Help your clients get to grips with MTD

Introduce the initiative to your clients by downloading our MTD client guide and sharing it with them.

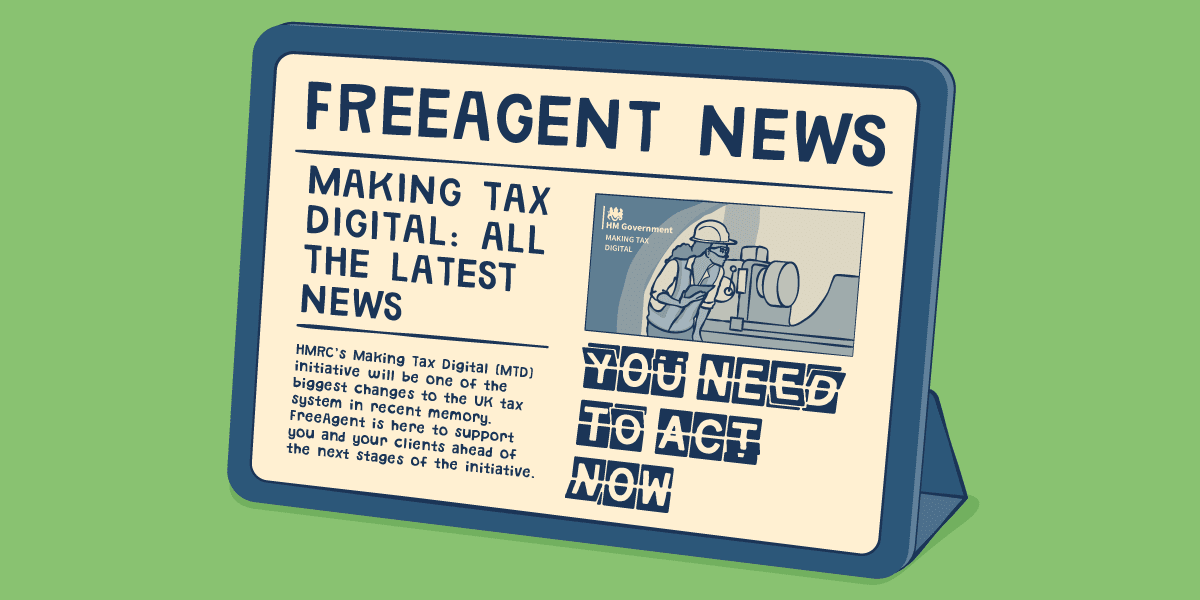

Download the guideMaking Tax Digital for VAT was introduced in 2019. It first required you to submit VAT returns on behalf of clients with VATable sales above the VAT threshold using compatible accounting software. The scope of MTD for VAT expanded on 1st April 2022, requiring you to do this for all VAT-registered clients.

Set your practice up for MTD for VAT

This guide explains exactly what you need to do to get set up for MTD for VAT with HMRC, and then submit MTD VAT returns for your clients through FreeAgent.

Get set up

Introduce the initiative to your clients by downloading our MTD client guide and sharing it with them.

Download the guide

Email templates, guides and tools to get you and your clients ready for MTD for VAT.

Download the pack

Encourage your clients to stay up to date with the latest news by keeping an eye on our blog.

Share the blog

FreeAgent is available free of charge for clients who have business current accounts with NatWest, Royal Bank of Scotland or Ulster Bank, for as long as the client retains their bank account. Find out more

FreeAgent is available free of charge for clients who have a Mettle account, as long as the client marks Mettle as their primary business account in the software. Find out more

Optional add-ons may be chargeable.