Everything you need to know about pensions when you’re self-employed

If you’re self-employed and you’re not currently paying into a pension, you’re not alone. Sorting out a pension when you’re self-employed might seem daunting but it’s well worth the effort. If you’re keen to get your pension sorted, here are some simple steps you can take to make a start.

Pensions: what are they and how do they work?

To kick things off, it’s important to understand what a pension entails.

Pensions are financial products designed to help you save for your retirement. While the rules can be restrictive, the government allows significant tax relief on savings. Pensions can be roughly grouped into three categories:

- The State Pension: pensions provided by the government for citizens. The State Pension is only paid out to people who pay National Insurance so if you’ve decided not to pay Class 2 National Insurance contributions (which are specifically for the self-employed), this could affect your eligibility for the State Pension.

- Workplace or occupational pensions: these pension schemes are offered by employers. With occupational schemes, employers and employees both contribute towards the pension fund. All companies must now offer a workplace pension scheme.

- Private pensions: individuals can also choose to buy into private pension schemes. These can be used as an alternative to occupational pensions and are a great option for the self-employed.

With workplace and private pensions, you build up your fund over time. The tax breaks on these pensions also benefit your retirement income later in life.

Once you reach the retirement age your pension scheme stipulates, you can take your pension out in a lump sum or sell it in exchange for a fixed income (known as an ‘annuity’) for the rest of your life.

Six simple steps to sorting out your pension stress

Step 1: see if you have any previous pensions

If you’ve ever worked as an employee, there’s a good chance you’ve got a pension pot kicking around somewhere.

While a pension fund is the financial product that you put money towards, the pension pot is the amount of money that’s been saved up. As a first step, it’s important to hunt these down. That way you can keep paying into these funds or transfer them to a new pot if you’d prefer.

If you know for a fact that you don’t have another pension from previous employment, skip to step 2.

Forgetting about existing pension pots is a common problem. The government has produced a handy tool that helps you track your pension pot down using the pension tracing service. There are also a few other ways you can get information about your existing pension pots:

- Check your old mail: pension providers are required to send you an annual statement each year to update you on their status. If you’ve previously signed up to a pension fund, there’s a good chance you’re getting letters about it.

- Contact previous employers: if you don’t have any letters about pension funds but think you have a pot out there, get in touch with your previous employers. The HR and finance teams should be able to help you track your pension fund down.

- Contact the pension provider: if you can remember the name of the pensions provider, get in touch with them to find out more about the details of your pension.

Step 2: think about what you want from your retirement

Before you choose a pension that’s right for you or decide how much you want to save, it’s important to have a good, long think about what you want from your retirement.

Whether you view retirement as a time to enjoy your savings or to be frugal, being clear on what you want from it will lead to more productive conversations with financial advisors. With a better grasp of your future aspirations, you’ll be able to make savings plans that are balanced against your current debts and outgoings.

Step 3: choose a financial advisor

If you find the pension landscape complex, it’s a good idea to find an independent financial advisor who can help you plan for the future methodically.

Financial advice isn’t usually cheap, but it’s important to consider the long-term advantages of getting professional advice from someone who knows the ins and outs of pensions and can help you plan properly for the future.

Step 4: take the time to understand the options available to you

Once you’ve got a meeting in the diary with a financial advisor, you’d be wise to do a bit of pre-reading on your pension options. You don’t need to be an expert by any means, but having a basic level of knowledge about the different financial schemes will help both you and your advisor. Here are just a few of the options available to you:

- Stakeholder pensions: commonly used by the self-employed, these are ‘defined contribution’ schemes. This means that what you get when you retire is based on how much you put in over time. Stakeholder pensions are generally run by insurance providers and come with the advantage of being closely regulated to help the contributor. This regulation means that stakeholder pensions usually have low management fees and allow for small contributions.

- NEST pensions: NEST (National Employment Savings Trust) is another defined contribution scheme. Rather than being run by a private insurance provider, NEST was set up by the Government to meet the increasing demand for pensions with the introduction of auto-enrolment.

- The State Pension: the State Pension is paid out by the Government to eligible people who reach State Pension age. You’re deemed eligible based on how many years you’ve been paying National Insurance. These are known as qualifying years. Not everyone is entitled to the full State Pension amount (currently £203.85 a week). Your qualifying years determine how much of the full pension you’re able to get. Qualifying years are determined by various factors, the full list of which can be found here. To find out if you qualify for the State Pension and how much you’re entitled to, try using the government’s pension checking tool.

Remember that if you’ve decided not to pay Class 2 National Insurance contributions, this could adversely affect your eligibility for the State Pension.

Think about your own retirement aspirations from Step 2. Is the State Pension enough for the future you want? Your financial advisor will be able to help you decide.

Step 5: come up with a plan with your advisor

Armed with an awareness of the basics of pension plans and an idea of your retirement aspirations, you’re hopefully feeling ready for a productive meeting with your financial advisor. Your advisor should be able to help you choose a pension provider and a plan that’s tailored to your needs. What’s more, by taking into account your current earnings and potential earnings in the future, they’ll be able to recommend how much you should be putting into the pot. Remember, you and your advisor should come up with a plan that you’re both comfortable with.

Step 6: start saving

With your new financial plan and pension scheme, you’re ready to take control of your financial future and start saving! Remember to keep a close eye on your outgoing payments and any debts you may have. You can find out more about how to save for a pension when you’re self-employed on our blog.

If you’re registered as an employee in your company or employ other staff, you can track pension contributions through FreeAgent.

Frequently asked questions about pensions

Is there tax relief on pensions when you’re self-employed?

Pension tax relief is available in the UK when you make personal contributions to a pension fund. This can be a personal pension or a workplace pension. How much relief you get depends on:

- your income

- how much you put into the fund

Your financial advisor or your accountant can help you figure out the tax relief you’ll receive. In most cases, tax relief will be applied automatically to the payments made to your pension fund.

I’m an employer - does auto-enrolment affect me?

If your business employs at least one person who isn’t a company director, you may be affected by auto-enrolment. Employees should be auto-enrolled in workplace pensions if they:

- are aged between 22 and the State pension age

- earn at least £10,000 a year

- ordinarily work in the UK

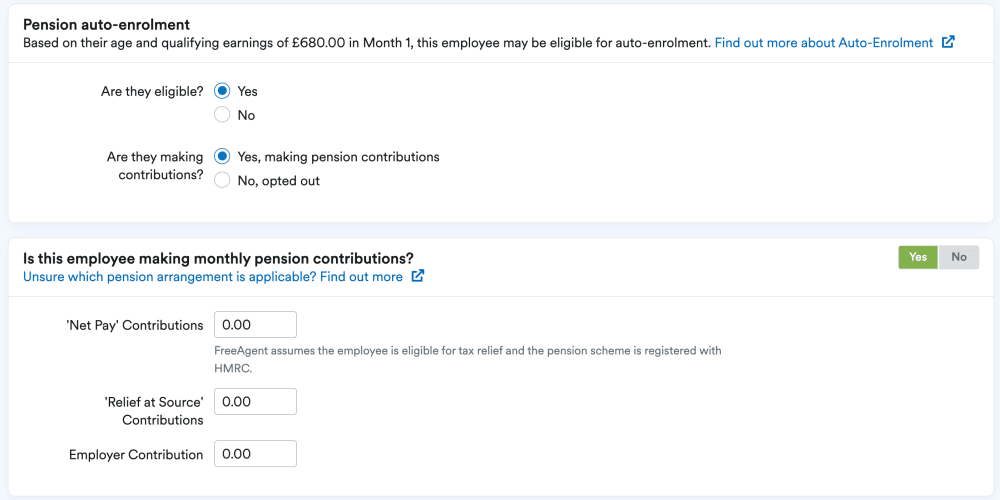

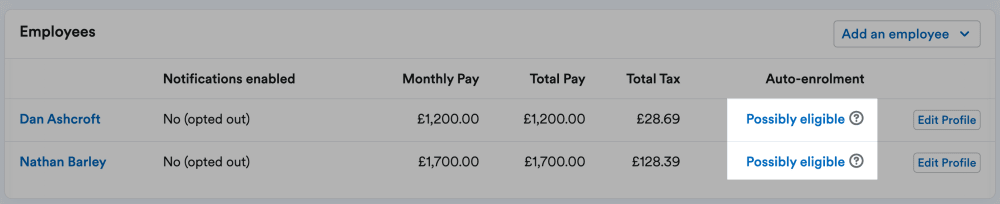

FreeAgent highlights those employees that may be eligible based on their date of birth and qualifying earnings.

This allows you to confirm whether highlighted employees are eligible for auto-enrolment.

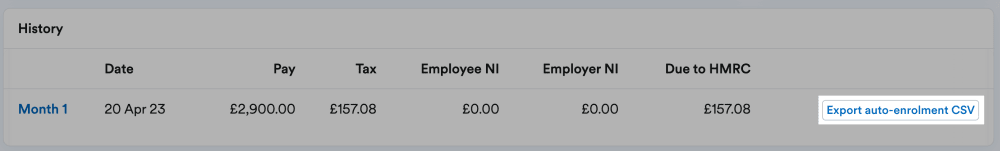

Each month, you need to send information to the pension provider your employees are enrolled with. FreeAgent allows you to easily export this data in a CSV format, enabling you to fill in the blanks in the CSV before sending it on to the pensions provider.

You can find out more about how FreeAgent supports auto-enrolment here.

What happens to my pension when I die?

This really depends on your pension and you should always check with your provider. When setting up a pension fund or amending old ones, it’s a good idea to ask your pension provider:

- if anyone will automatically inherit your fund when you die

- if you can nominate your spouse or next of kin

- if there are any limitations to beneficiaries inheriting your pension or restrictions to how much can be passed on

If your spouse or civil partner is of retirement age when you die, they may also be entitled to some of your State Pension.

And remember, if in doubt, always chat to your financial advisor!

When can I access my pension?

The State Pension age is currently 66 years old for both men and women but will start gradually increasing from 6th May 2026. You can check your State Pension age on the government’s website. While you can often access your pensions from the age of 55 onwards, it’s best to double check this with your pension provider.

Self-employed and thinking about getting a mortgage? Check out our guide to find out what you steps you need to take.

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.