How to complete your Self Assessment tax return

Once you’ve registered for Self Assessment, you can complete your Self Assessment tax return and file it to HMRC. In this guide, we’ll help you understand how to complete and file your tax return online.

Before you start

Who needs to file a Self Assessment tax return?

You’re likely to be legally required to register for Self Assessment and send a tax return to HMRC for the 2024/25 tax year if any of the following applied to you during the tax year (6th April 2024 - 5th April 2025):

- you were self-employed as a ‘sole trader’ and earned more than £1,000

- you were a partner in a business partnership

- you had to pay the High Income Child Benefit Charge and do not pay this already through PAYE

Further reading: Do you have to file a Self Assessment tax return?

Self Assessment deadlines

There are a number of other deadlines relating to Self Assessment throughout the year, but the big three are:

- 31st July: making your second payment on account

- 5th October: registering for Self Assessment for the previous tax year

- 31st January: filing your online tax return and paying any tax you still owe for that tax year, plus making your first payment on account for the next tax year

Further reading: Self Assessment deadlines: when to register, file and pay

Did you know? 💡

Starting from April 2026, Making Tax Digital (MTD) for Income Tax will begin to replace Self Assessment for many self-employed individuals and unincorporated landlords.

Instead of filing a tax return on paper or via the internet once a year, you will have to keep digital records and file updates to HMRC each quarter, as well as completing an annual final declaration. You can find out everything you need to know about MTD for Income Tax in our dedicated hub.

Gathering your documents

Having all your information ready before you start completing your tax return will make the process much smoother.

For starters, you’ll need the following information in order to fill in your tax return:

- your Unique Taxpayer Reference number

- your National Insurance number

- a P60 from your employer (if you were also employed during the tax year)

- a P45 (if you have left a job during the tax year)

- details of any other taxable income (such as from property, investments, or foreign income)

- details of all your business income

- a record of any allowable business costs

- a record of contributions to pensions or charities (for tax relief)

- details of any dividend payments received

Further reading: Everything you need to fill out and file your Self Assessment tax return

Completing your tax return

Once you’ve gathered all the information you need, you’re ready to start filling in your tax return. There are a few ways you can do this.

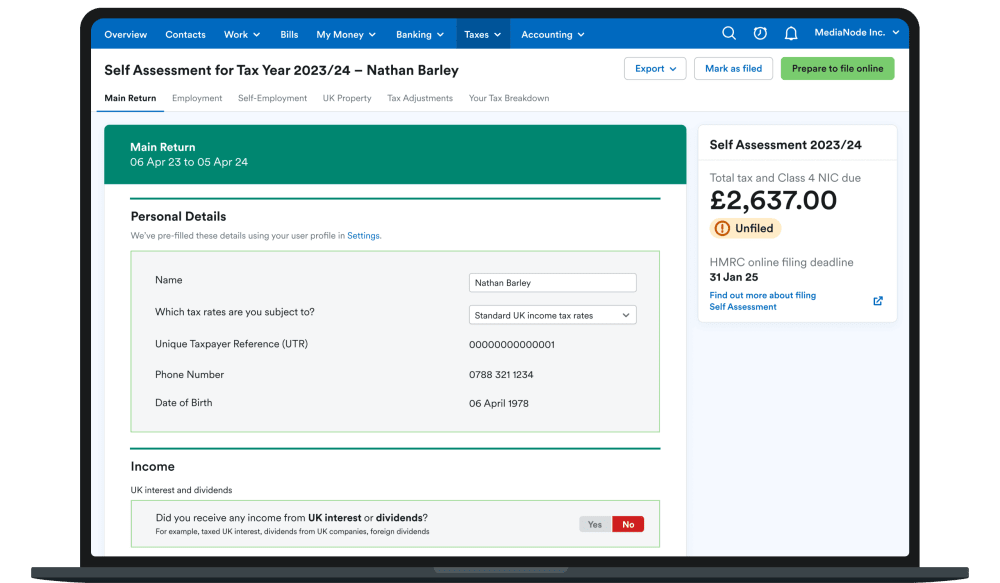

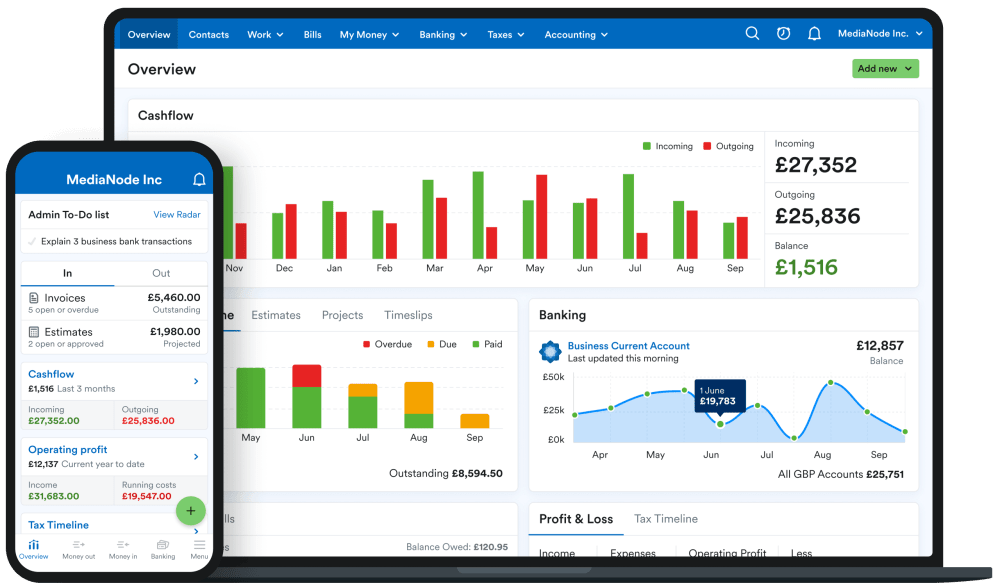

Using accounting software

If you’re using accounting software to manage your business finances, there may be a process for completing your Self Assessment tax return within the software.

If you’re using FreeAgent, you can even file your tax return directly to HMRC from within the software!

Further reading: How to file a Self Assessment tax return in FreeAgent

On the gov.uk website

You can also complete and file your tax return online using the gov.uk website.

1. Sign in and start your return

- Go to the gov.uk website and sign in to your HMRC online services account.

- Navigate to the ‘Self Assessment’ section and choose to complete your return for the relevant tax year.

2. Tailor your return

You will be asked a series of questions to determine which sections of the tax return you need to complete. This will include questions about your employment status, self-employment, property income, and other sources of income.

3. Fill in the relevant pages

Based on your answers in the ‘Tailor Your Return’ section, you will be presented with the relevant pages of the tax return to fill in. All tax returns contain an SA100 main section, then there are supplementary pages for your different other sources of income. Different pages you might encounter include (this list is not exhaustive):

- SA100: this is the main section of the tax return

- SA102: for employment income

- SA103S or SA103F: for self-employment income

- SA105: for UK property income

- SA108: for capital gains (which would apply if you sell certain assets, such as a second home)

For each section, you will need to enter the relevant information from the documents you’ve gathered above. The online system will guide you through each part and you can save your progress and come back to it at any time.

If you’re unsure about which pages you need to fill in, you should check with an accountant who will be able to advise you.

4. Claiming expenses and reliefs

If you are self-employed, you may be able to deduct allowable business costs from your taxable profit to reduce your tax bill. Depending on your circumstances, these might include (list not exhaustive):

- office costs (e.g, stationery, phone bills)

- travel costs (e.g, fuel, parking, train tickets)

- clothing expenses (e.g, uniforms)

- financial costs (e.g, insurance, bank charges)

All taxpayers may also be able to claim tax relief on things like pension contributions and charitable donations. You should always check with an accountant if you’re in any doubt about what you can claim for.

Further reading: Allowable costs for small businesses

5. File your tax return

Once you have filled in all the relevant pages, the system should automatically calculate how much tax you owe.

Carefully review all the information you have entered. Once you and your accountant are happy that everything is correct, you can file your return. You will get an on-screen confirmation and an email from HMRC.

Paying your tax and NI bill

The deadline for paying your bill for this tax year (and your first payment on account if applicable) is also 31st January.

There are several different ways to pay your Self Assessment tax bill, including:

- Direct Debit

- online banking

- personal debit card

- corporate debit or credit card

- bank transfer using CHAPS, Faster Payments or Bacs

- in-branch at your bank or building society

- by cheque through the post

Remember the payment must reach HMRC by 31st January to avoid interest and late payment penalties - so make sure your payment is sent in plenty of time.

Further reading: How to pay your Self Assessment tax bill

If you make a mistake on your tax return

If you realise you have made a mistake after submitting your return, you can amend it online up to 12 months after the filing deadline. We strongly recommend that you check with HMRC or an accountant before making any changes to a filed tax return.

Further reading: How to amend a Self Assessment tax return after filing it

Disclaimer: The content included in this guide is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this guide. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.