VAT-tastic

Roan Lavery

CEO, Co-founder

In this update we release a number of improvements to our VAT handling, including support for VAT handling of EU sales, and announce online filing with HMRC.

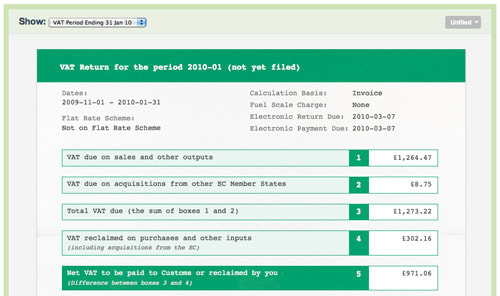

All new VAT returns

You’ll first notice your VAT returns now have a completely new design. It’ll look more familiar to those of you who’ve filled in one of the old paper forms.

As mentioned previously, changing the status of a VAT return automatically changes any older ones, so if you mark a return as ‘filed’, all earlier ones will also be marked as filed too.

Buying and selling within the EU

Lots of our customers buy and sell goods and services to countries in the wider EU and FreeAgent is now able to give you more help to record these transactions on your VAT return.

All the information you need is in the Knowledge Base:

- Create an invoice to sell goods or services to a customer in the EU

- Record a bill for goods or services bought from the EU

- Enter an EU bank transaction, receipt or payment

- Record an out-of-pocket expense for costs incurred in the EU

- FreeAgent will now fill in boxes 2, 8 and 9 on your VAT returns where HMRC require it.

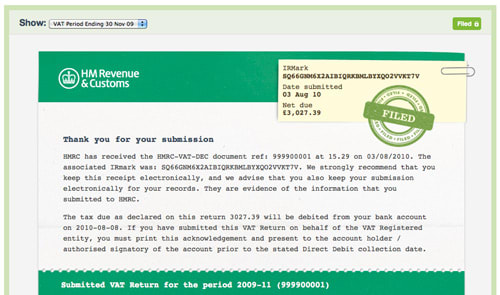

Online VAT filing

The big announcement is that FreeAgent now supports online filing of VAT returns to HMRC!

Before you rush off, be aware that we are rolling this feature out gradually to make sure there are no bugs, but all being well this will be available to everybody soon. When that happens, we’ll publish full details about how it all works.

It’s not just VAT though

Actually, it mostly is, but we also:

- Added support for next year’s 20% VAT rate

- Added support for next year’s Flat Rate Scheme rates

- Allow you to add default Additional Text to recurring invoices , just like normal ones.

- We’ve added support for the Vietnamese Dong, Latvian Lats and Egyptian Pound!