FreeAgent and New UK Tax Codes

Ed Molyneux

Founder

A minor addition overlooked in last week’s release Anjou release announcement was the ability to update an existing payroll with revised tax code.

This was introduced to allow brave citizens of the United Kingdom to amend their tax codes following a late revision in this year’s budget.

If your tax code has been affected you just need to:

- Select Setup Payroll from this year’s payroll screen, and

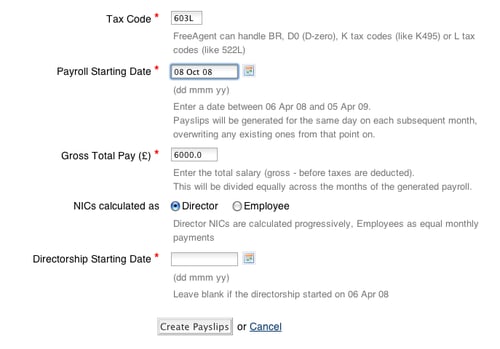

- Enter your revised tax code, a start date corresponding to the next payslip after the 7th September, and the remaining amount of gross salary to be paid this tax year

FreeAgent will then recalculate the remainder of this year’s payslips while leaving the earlier ones in place (which wasn’t possible before) and adjusting the tax due to allow for the revised tax code (based on what’s been paid already, of course).

The revised tax bands are also correctly represented in our Self Assessment calculations (and have been since April) but these are not used to calculate payroll - that’s what the tax code is for. For more details on the riveting subject of tax codes see this article at Directgov.

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.