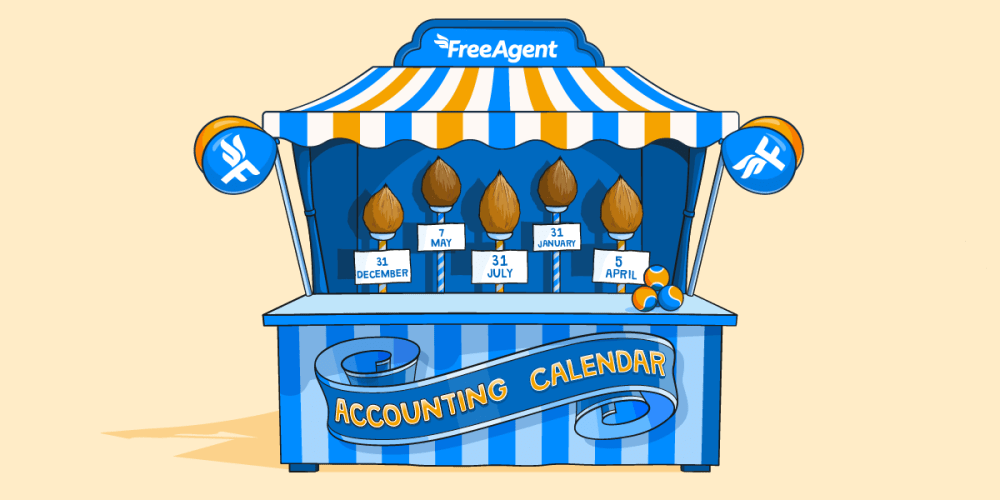

Small business accounting calendar 2026: key tax dates and deadlines

Step right up, step right up - think you’re ready to topple your tax obligations in 2026? Turns out, it takes just five minutes to plan for the year ahead, but that one good choice will save you so much stress later.

Everyone gets a prize, as we’ve put together a timeline of the most important accounting dates for business owners and freelancers during the year - including a download link to easily add this to your own calendar. Some businesses may have additional deadlines to track as well, like quarterly VAT returns or payments on account.

Please note: If you’re self-employed or a landlord, you will need to stay up to date with the government’s rollout of Making Tax Digital (MTD) for Income Tax. Instead of sending a Self Assessment tax return to HMRC once a year, MTD for Income Tax will see businesses submit four quarterly updates about their business income and expenses. At the end of the tax year, they will also have to send a final declaration.

From 6th April 2026, self-employed people and landlords with a total business or property income (not profit) above £50,000 per year will need to move to the new system. If you need to sign up this year, our dedicated guide covers all the new MTD deadlines you’ll need to know, and how they impact your final Self Assessment return.

Calendar of a typical small business tax year in the UK

Here’s how an average tax year for a UK-based small business might look. It’s important to bear in mind that the tax deadlines you have for your own business are unique to your circumstances, and your obligations to HMRC will depend on many factors. These include whether you have any employees or if you’re running your business as a ‘side hustle’ while in full-time employment.

For extra clarity on your tax obligations, we recommend working with an accountant if you’re not doing so already.

January

1st - Corporation Tax payment deadline (if you have a limited company with an accounting year end of 31st March 2025)

31st - Self Assessment filing deadline for 2024/25 online tax returns

31st - Deadline for any remaining tax you owe for the 2024/25 tax year (known as a balancing payment) as well as your first payment on account for 2025/26’s Income Tax and National Insurance

March

31st - Corporation Tax return filing deadline for most limited companies with an accounting year end of 31st March 2025

April

1st - New financial year for limited companies, when most updates to Corporation Tax rates, etc come into play

6th - New tax year! The Chancellor’s planned updates to any tax rates, wage rates and minimum pension contributions (among other things) for individuals and unincorporated businesses will come into effect today

6th - Deadline to sign up for MTD for Income Tax for sole traders and landlords with a total business or property income above £50,000 per year (for more information, see the full list of deadlines for year one of MTD)

May

31st - Deadline for issuing any employees with their annual P60s covering 2025/26

July

6th - Deadline for filing P11D and P11D(b) forms (if applicable)

19th - Deadline for paying Class 1A National Insurance Contributions non-electronically (you’ll only pay this on benefits you give to your employees, such as private medical insurance)

22nd - Deadline for paying Class 1A National Insurance Contributions electronically

31st - Second Income Tax and National Insurance payment on account deadline

October

31st - Deadline for filing 2025/26 Self Assessment paper tax return (for those not filing online)

December

31st - Deadline for filing most limited companies’ annual accounts for the year ended 31st March 2026

A note on payments on account

If less than 80% of your income is paid at source and your tax bill is over £1,000, you’ll need to make payments on account. These are advance payments on your next year’s Self Assessment tax bill. Your payments on account are calculated by dividing the amount of Income Tax and Class 4 National Insurance from your most recent Self Assessment tax return bill by two. You need to make the first payment by 31st January and the second payment by 31st July.

A note on VAT return deadlines

The vast majority of small businesses will file a VAT return four times a year. Making Tax Digital (MTD) for VAT legislation requires all VAT-registered businesses to do this through MTD-compatible software like FreeAgent. The most common set of quarterly VAT return dates is:

- 1st January - 31st March

- 1st April - 30th June

- 1st July - 30th September

- 1st October - 31st December

Each VAT return is due for filing one month and seven days after the end of one of these quarterly periods. So for example, the VAT return that covers 1st January - 31st March needs to be filed to HMRC by 7th May.

Add key dates directly to your calendar

Do you want reminders of every important tax date? Download our free accounting calendar, ready to import to your favourite calendar app.

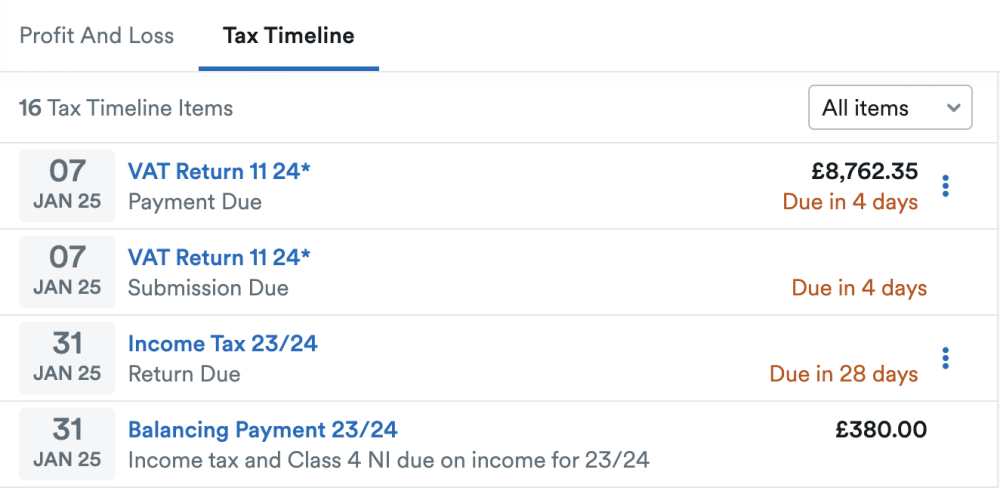

FreeAgent’s Tax Timeline to the rescue

If you use FreeAgent, you’ll notice that the deadlines that apply to you appear in the Tax Timeline on your Overview screen.

Want to see FreeAgent’s unique Tax Timeline in action? Try our award-winning software for free with a 30-day trial today.

Originally published

Last updated

Disclaimer: The content included in this blog post is based on our understanding of tax law at the time of publication. It may be subject to change and may not be applicable to your circumstances, so should not be relied upon. You are responsible for complying with tax law and should seek independent advice if you require further information about the content included in this blog post. If you don't have an accountant, take a look at our directory to find a FreeAgent Practice Partner based in your local area.