It’s snowtime! FreeAgent now supports Self Assessment property pages

Roan Lavery

CEO, Co-founder

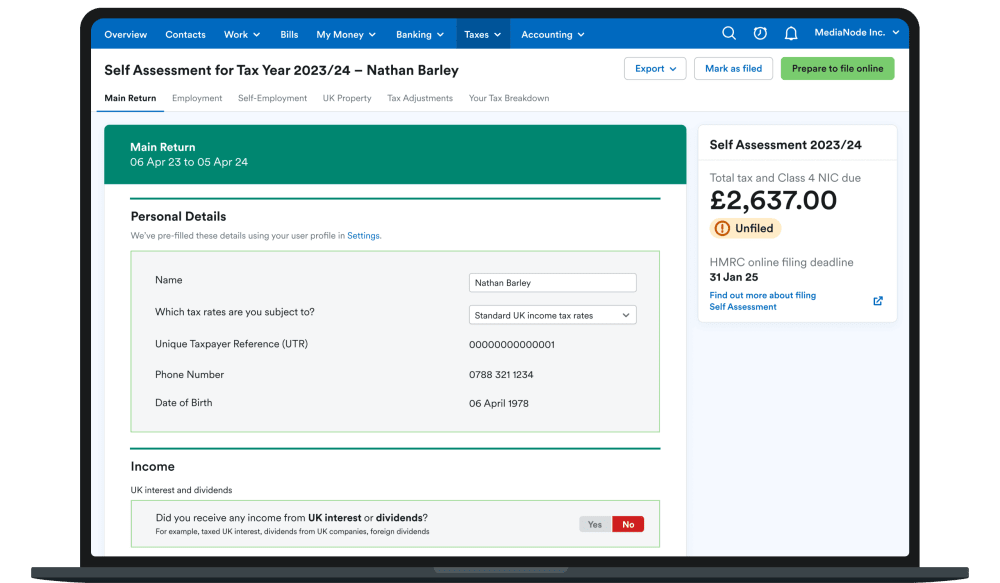

It’s the final stretch to the holidays, but ho-ho-hold on, there’s time for one more FreeAgent product update! We’re wrapping up the year with an addition to our Self Assessment functionality. If you have a sole trader or limited company account in FreeAgent and you manage a property, you can now record your property income on your Self Assessment tax return.

Now that FreeAgent supports the UK property page (SA105) for sole traders and limited company directors, when you complete your Self Assessment tax return in FreeAgent, you’ll be given the option to include and complete the relevant property pages.

The self-employment (SA103) page has also been added to limited company account types, allowing you to enter details of any self-employment income that limited company directors have earned and include them with your submissions.

Find out more on the Knowledge Base or log in to FreeAgent to view the property page on your Self Assessment tax return. And while we’re on the topic, remember the 31st January deadline to file your return online is fast approaching. But don’t worry if you have other things on your mind, your friendly accounting software will be back in the new year to keep you on the (snow)ball.

If you’re an unincorporated landlord looking for even more functionality to help you manage your property income, find out more about FreeAgent for Landlords.