Clients can get FreeAgent tax and invoicing data in their business banking apps

A new expansion of FreeAgent’s innovative integration with NatWest, Royal Bank of Scotland and Ulster Bank business accounts means customers can now see their tax calculation and invoice details within their banking app.

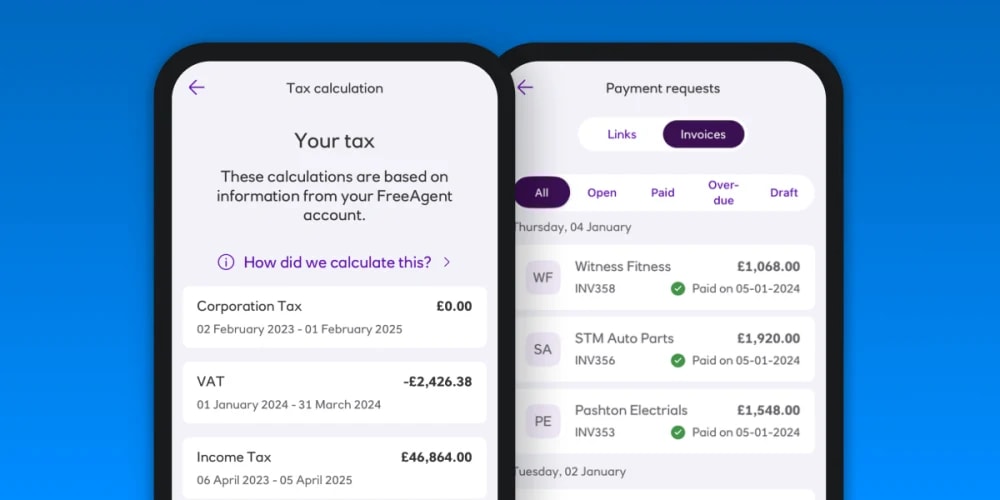

We’ve been working closely with the banks to give users a seamless experience by bundling banking and accounting together in one place and giving your clients easy access to their key financial data. If your clients retain a business bank account with NatWest, Royal Bank of Scotland or Ulster Bank, they can now access their tax calculation and insights and view their invoices from within their banking app by connecting to FreeAgent. Here’s what’s new:

Grow tax confidence

Clients can take a weight of their minds and be prepared by knowing how much tax they owe, setting aside enough money to cover their upcoming tax bills. Hot off the heels of the release of FreeAgent’s Tax Timeline in the Mettle app, your clients can now access a real-time view of their:

- FreeAgent Tax Timeline of upcoming tax events e.g. submission and filing dates, and payment due dates

- total tax calculation of outstanding tax liabilities

- individual tax calculations by tax type e.g. VAT, Corporation Tax, Income Tax and payroll

View and track latest invoices

Getting paid is a key factor for keeping cashflow healthy. With access to their FreeAgent invoicing information in their banking app, clients can easily keep track of their finances, what they’re owed and the live status of all their invoices. Now they can:

- view all of the invoices that they’ve created in FreeAgent

- view and filter those invoices to see what’s due (or overdue) and when

- jump into the FreeAgent mobile app with one tap if they need to create and send new invoices

Get started

To start seeing the tax calculation and invoicing data, all your clients need to do is connect their bank account to FreeAgent. They can do this from a number of areas within their banking app, either from the ‘Tax and Accounting’ screen, payment request screens or via the ‘manage connections’ section if they bank with NatWest. Next, they’ll be prompted to follow a few easy steps to approve the connection. Once they’re done, their tax and invoicing information will be displayed in their banking app.