Our depreciation support has moved up another gear

We’re pleased to announce to our Practice Partners that we’ve taken our depreciation support up a gear by further extending our capital asset and depreciation functionality. You can now set default depreciation methods and capital allowance treatments for all new and existing capital asset categories.

To help you support your clients’ capital asset management and depreciation needs, we recently added support for the reducing balance method of depreciation, assets that don’t depreciate and assets depreciating on a monthly basis. We also added support for asset lifetimes of up to 25 years when depreciating using the straight line method and a more detailed capital asset report.

To move our capital asset and depreciation functionality up another gear, we’ve now added support for the following:

- Default depreciation methods and capital allowance treatments for new capital asset types

- A default nominal code for land and property assets in new FreeAgent accounts

- A net book value running balance for individual capital assets

- Exporting the Capital Asset report

These new updates will help speed up the capital asset management process and give even more support to your clients with more sophisticated accounting needs. Being able to select default depreciation methods and capital allowance treatments for new and existing capital asset categories will reduce the need to edit assets in those categories after recording the purchase. Having default nominal codes for land and property assets will reduce the need for creating custom capital asset categories to record these purchases.

Here are the details.

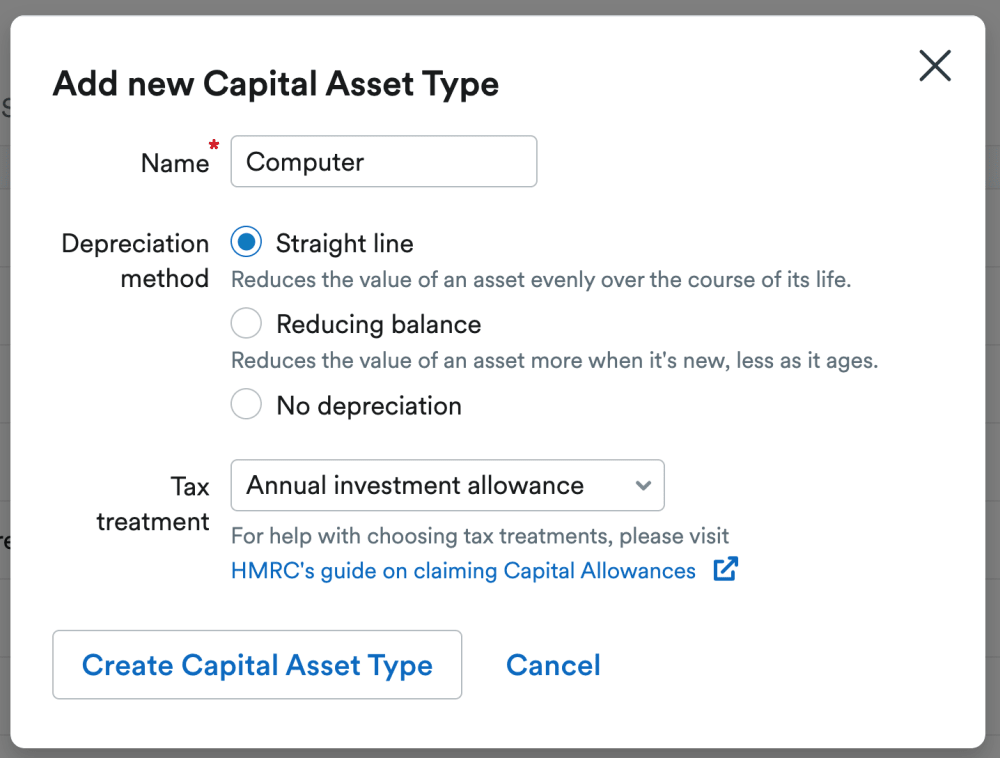

Default depreciation methods for new capital asset types

When adding a new capital asset category, or updating an existing capital asset category, you can now select a default depreciation method and capital allowance treatment to be applied to new assets created using that category. Updating the default options will not impact existing assets created using those categories.

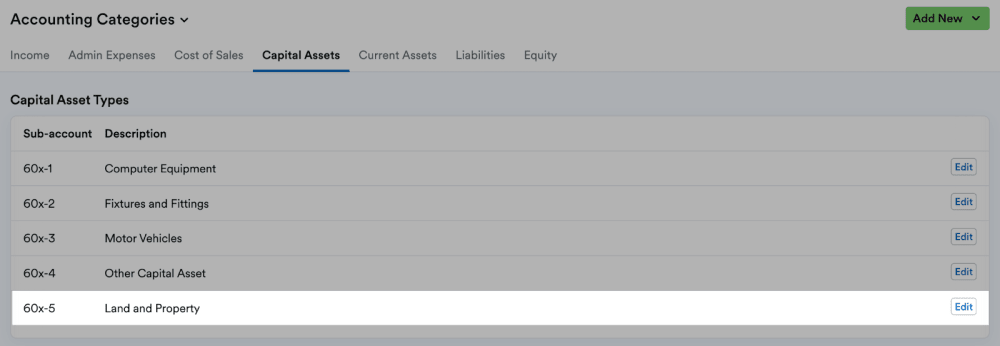

Default nominal code for land and property assets in new FreeAgent accounts

New FreeAgent accounts created from 9th May 2024 will contain a default nominal code for land and property that doesn’t depreciate and on which you can’t claim any capital allowances. This new nominal code won’t be added to FreeAgent accounts created before 9th May 2024 to avoid potential collisions with pre-existing custom categories using the same nominal code.

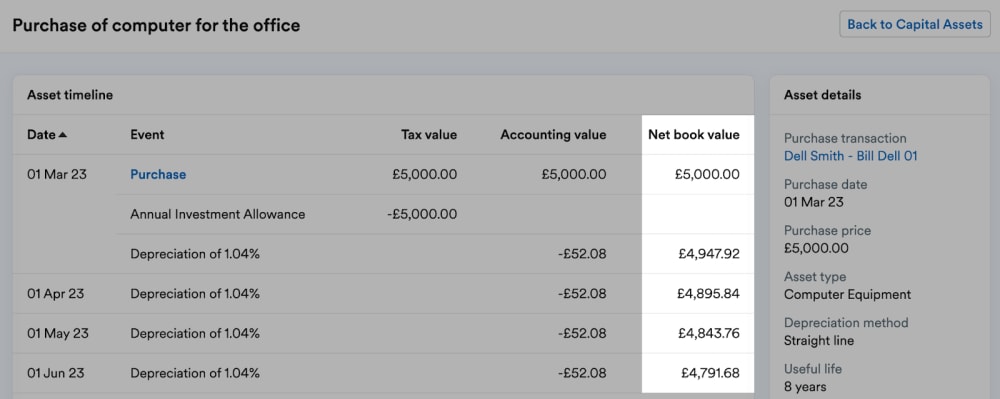

A net book value running balance for individual capital assets

When you view an asset in the Capital Assets report, you’ll now be able to see its ‘Net book value’ running balance.

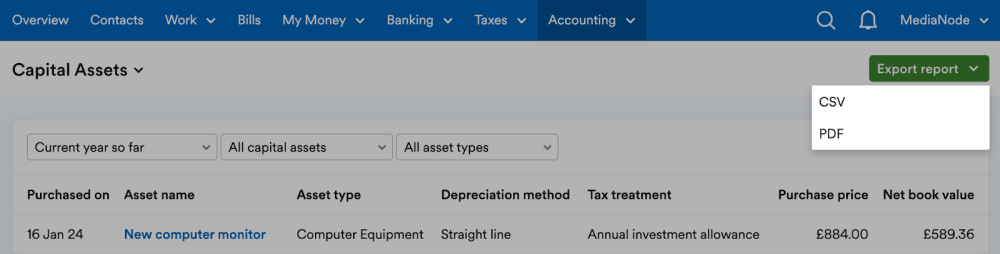

Exporting the Capital Assets report

You can now export the Capital Assets report as a .CSV or .PDF file.