Cash basis accounting support is now live

This article was last updated on 14th July 2022.

We recently rolled out FreeAgent for Landlords, which includes support for cash basis accounting. We’re pleased to say that this option is now also available in FreeAgent’s UK sole trader and partnership account types - and FreeAgent now supports Self Assessment filing for sole traders who use the cash basis.

Previously, FreeAgent always calculated accounts using the traditional (accruals) basis of accounting. Now, when you set up a new client as a sole trader, partnership or unincorporated landlord on FreeAgent, you have the option for their accounts to be calculated using the cash basis of accounting instead.

The main difference between the accruals basis and the cash basis of accounting in FreeAgent is when income and costs are recorded on the client’s profit and loss report. We’ve kept some important elements of the accruals basis of accounting in the background, however. For example, it’s still possible to check how much your clients are owed in trade debtors, and you can still see the values of their capital assets. See our Knowledge Base for more details.

Please note that HMRC only permits cash basis accounting to be used by sole traders, unincorporated landlords and partnerships with a turnover of £150,000 or less per year. It’s not possible to use the cash basis of accounting to prepare accounts in FreeAgent for a limited company or limited liability partnership, or for any business based outside the UK.

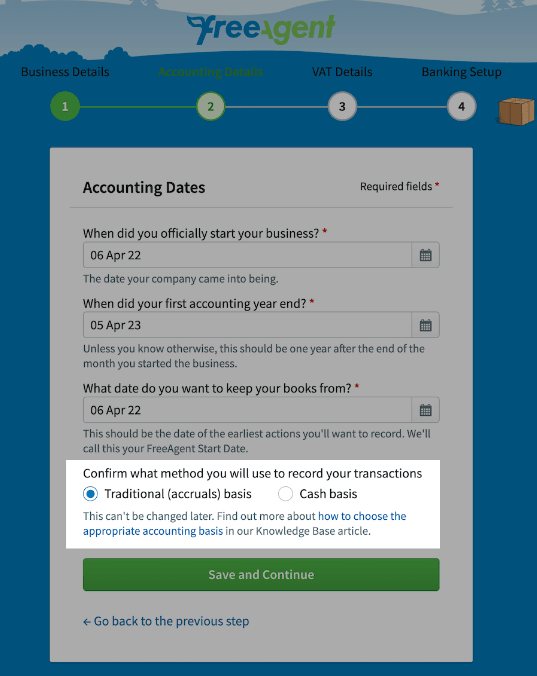

How to select cash basis accounting for a client account

When setting up a ‘UK Sole Trader’, ‘UK Partnership’ or ‘UK Unincorporated Landlord’ account type in FreeAgent, you’ll be asked to confirm whether you’d like to prepare accounts using ‘Traditional (accruals) basis’ or ‘Cash basis’ accounting.

Please note that FreeAgent’s Payroll and Stock features are not currently available when using cash basis accounting.