Make light work of the new tax year

Take a weight off your mind this new tax year with FreeAgent's award-winning accounting software.

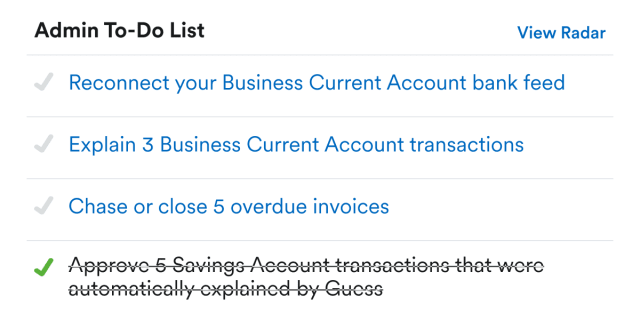

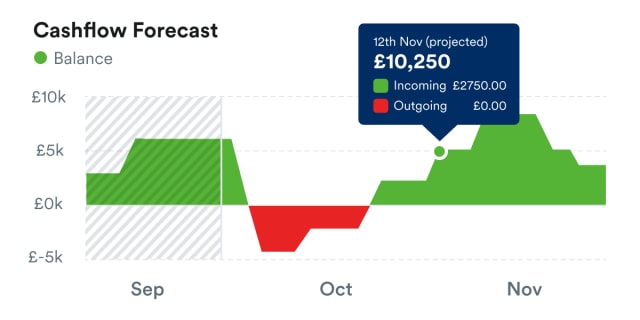

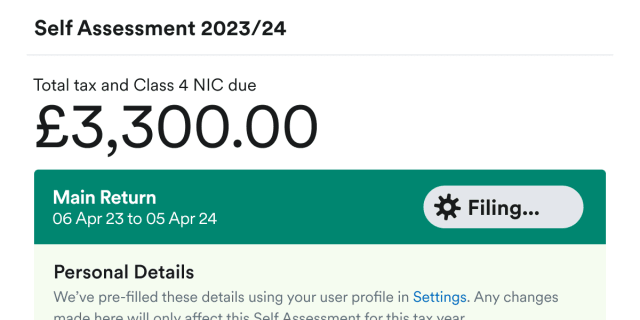

Nail the daily admin, see your cashflow 90 days ahead, take care of tax and file directly to HMRC.

Try FreeAgentTake a weight off your mind this new tax year with FreeAgent's award-winning accounting software.

Send invoices, manage expenses, file tax returns, check your cashflow. And do it all on the go.

Still using spreadsheets? Discover a fresh start with FreeAgent, and see how we compare to other software.

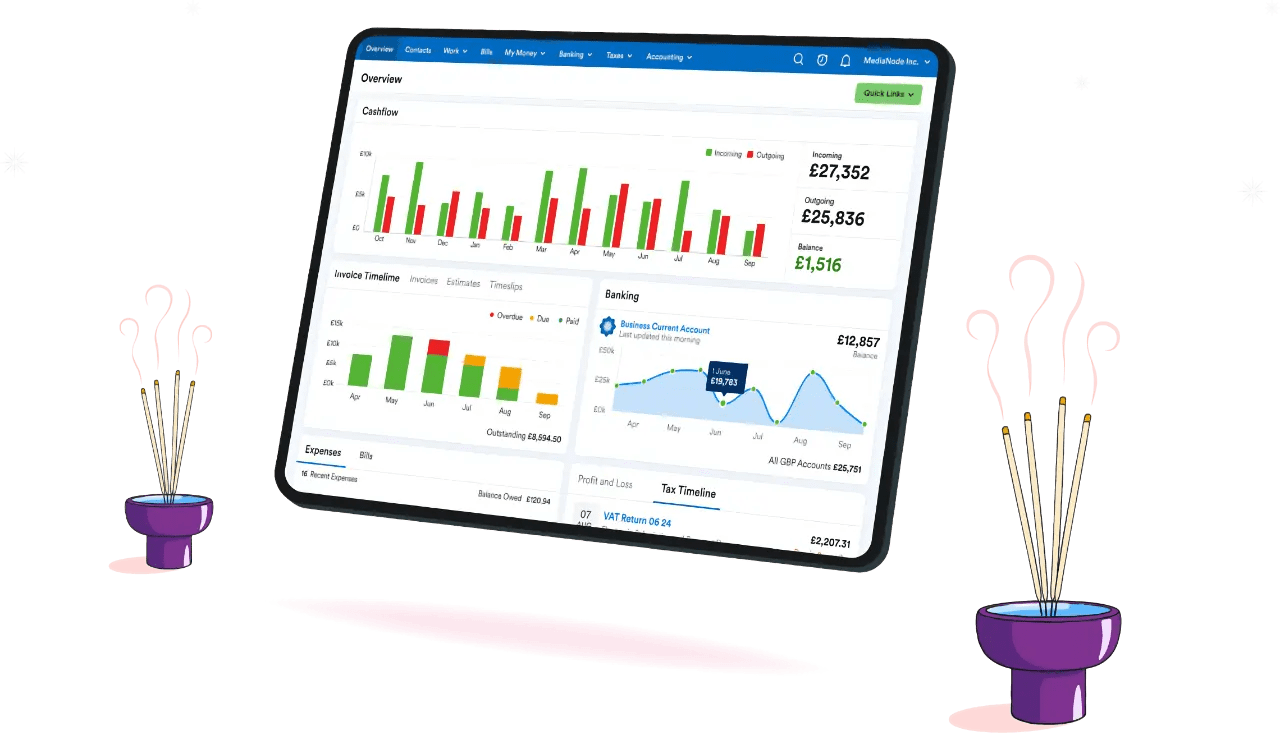

No more mess - invoicing, expenses, and more all in one place

One tidy dashboard that gives an overview of your whole business

No payment card needed.

Try FreeAgentGary, Gillian, Mike and Moriah are just some of the friendly, UK-based support accountants who are ready to help when you get stuck.

FreeAgent works great either way.

If you’re looking for the support of an accountant, we’ve got you covered – choose an accountant from our directory of trusted partners.

No more swapping spreadsheets with your accountant - send them an invite and start working from the same set of books.

No accountant? No problem. You can use FreeAgent accounting software without an accountant, especially if your books are straightforward.