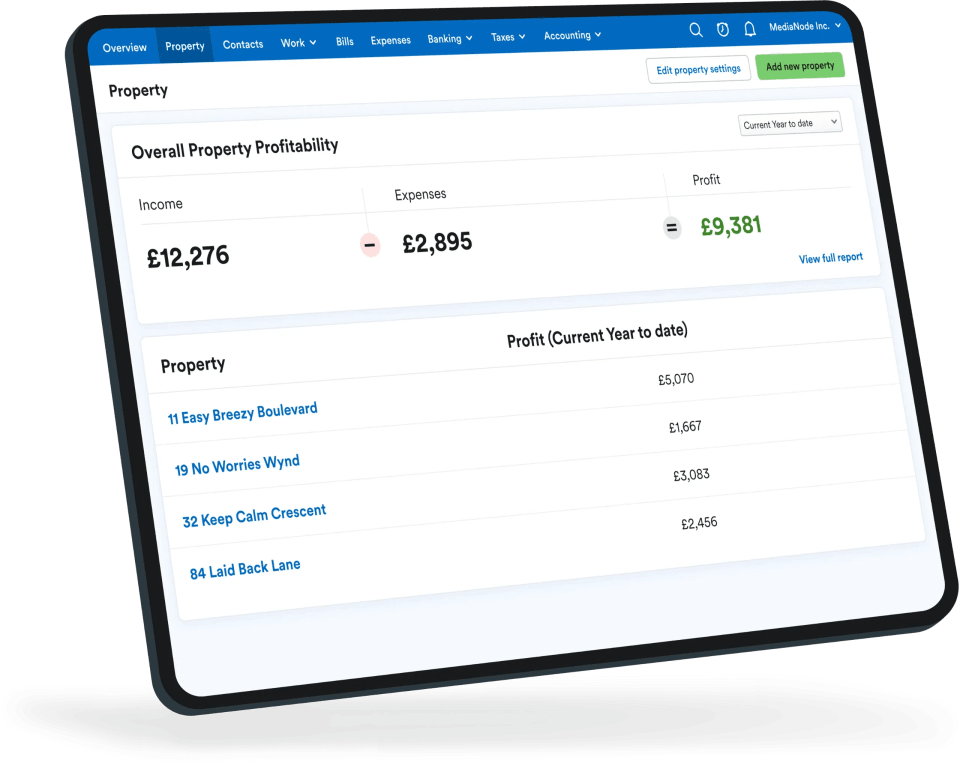

My landlord clients love how intuitive FreeAgent is for keeping track of properties and profitability.

FreeAgent for Landlords lets them get on with letting.

Try FreeAgent for freeAre you a landlord? Find out more about using FreeAgent for Landlords directly.

Unincorporated landlord clients can keep digital records and you can submit their Self Assessment and MTD for Income Tax returns directly to HMRC.

Partners and co-owners can each make their own MTD submissions within the same account, making it simple to manage shared portfolios.

Try FreeAgent for free

Clients can set different ownership splits across their portfolio, attribute income and costs, and view profitability and tax liability.

From your first call to client migration and beyond, we’ll be with you every step of the way.

FreeAgent is MTD ready and also supports Self Assessment, including UK property (SA105) pages on behalf of your clients.

My landlord clients love how intuitive FreeAgent is for keeping track of properties and profitability.

With MTD for Income Tax fast approaching, FreeAgent was an easy fit for our landlord clients to manage their quarterly reporting seamlessly.

With MTD we knew FreeAgent would have us covered and we were absolutely right.

Yes, you read that right - if your clients retain a NatWest, Royal Bank of Scotland or Ulster Bank business current account, or make Mettle their primary bank account in FreeAgent, they're eligible to use FreeAgent for free. Optional add-ons may be chargeable.

Want to find out more? Get in touch with our team by filling in the form below.

Once you submit a request form, you can either book a time slot or we'll call you within two working days. Whichever you choose, we'll be in touch to find out more about your practice and talk you through our software.

Not an accountant or bookkeeper? You might be looking for our free trial for small businesses.

Submitting your details indicates that you are happy for FreeAgent to contact you about relevant services and offers. You can unsubscribe at any time. We are committed to keeping your information safe. Read our Privacy Policy to find out more.